Google and Ipsos MediaCT recently unveiled an extremely revealing report on how travelers behave online when planning their next trip, whether it’s for leisure or business. Between April and May 2012, over 5,000 American consumers responded to an extensive survey to better understand how their travel decision process, depending if they were leisure travelers (took at least one trip for leisure in the past 6 months), business travelers (took at least 3 trips in the past 6 months) or affluent travelers (took at least one trip for leisure in the past 6 months & have a household income of $250k+).

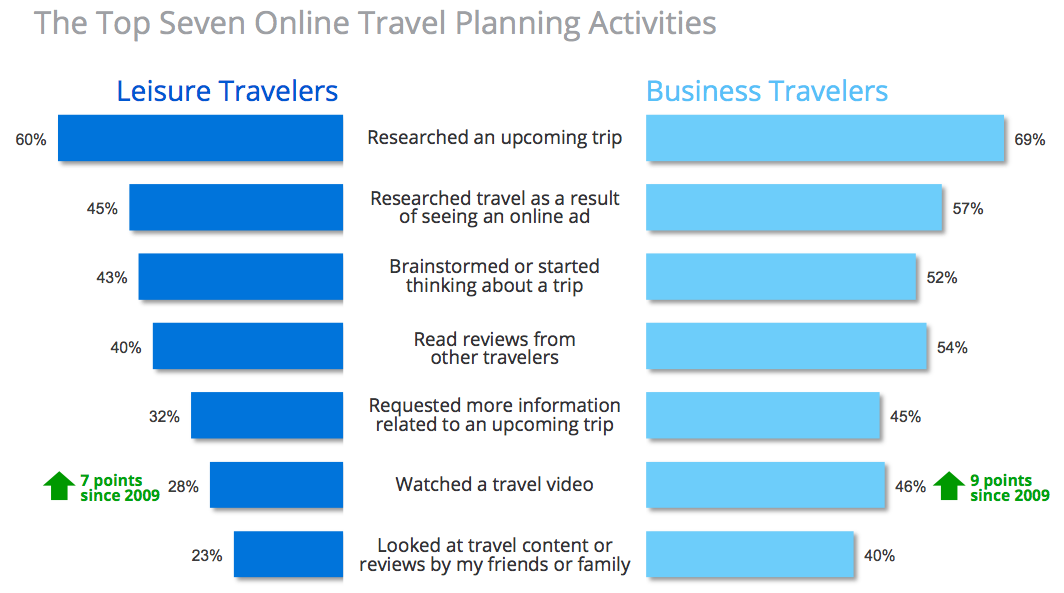

Most travel marketers intuitively know that travelers research travel online in various, different ways. The report confirms this, in particular when looking at the top 7 online travel planning activities:

56% of travelers say they “always start the travel booking and shopping process with search”, yet 96% of leisure travelers have started their hotel planning with search. Certainly a finding that hotel marketers will take good note of!

LEISURE AND BUSINESS TRAVELERS PRIORITIZE SEARCH DIFFERENTLY

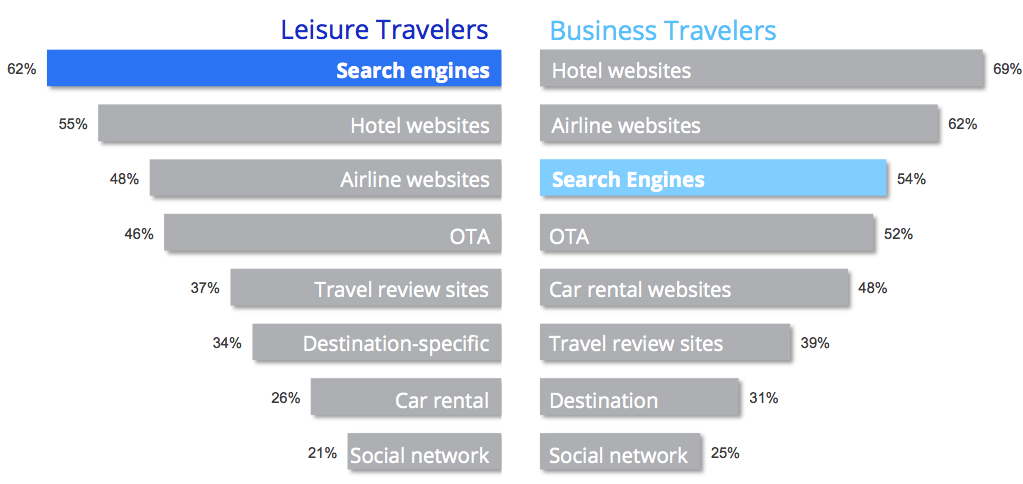

With so many online tools available in the travel decision making process, which of the online sources do travelers typically use to plan leisure or business trips? Here again, the report finds interesting variances, as can be seen in the chart below:

In other words, if you are targeting leisure travelers in particular, you’d want to have a solid content strategy in place, combined with an efficient search marketing strategy, i.e. using Google AdWords for example. Why? Because your property has to show up when leisure travelers are searching online, as it is their first source (62%).

For business travelers, these results demonstrate the importance of having a strong brand, i.e. Fairmont, Intercontinental, Starwood, etc. Business travelers go directly to the hotel or airline site, before thinking of search engines. The biggest surprise? Online Travel Agencies (OTA) ranking only 4th catches me somewhat off-guard. I thought Expedia, Priceline, Hotwire, Bookings.com or Hotels.com would have come up higher, in particular with leisure travelers…

MOBILE VS COMPUTERS

In 2009, only 8% of leisure travelers and 25% of business travelers used a mobile device to access internet for travel information. In 2012? 38% of leisure travelers and 57% of business travelers now do so, confirming a long-term growth trend. This phenomenon is happening at the expense of computers, whether it’s at home or the office. Both leisure and business travelers say they access less the internet for travel-related information on their computers.

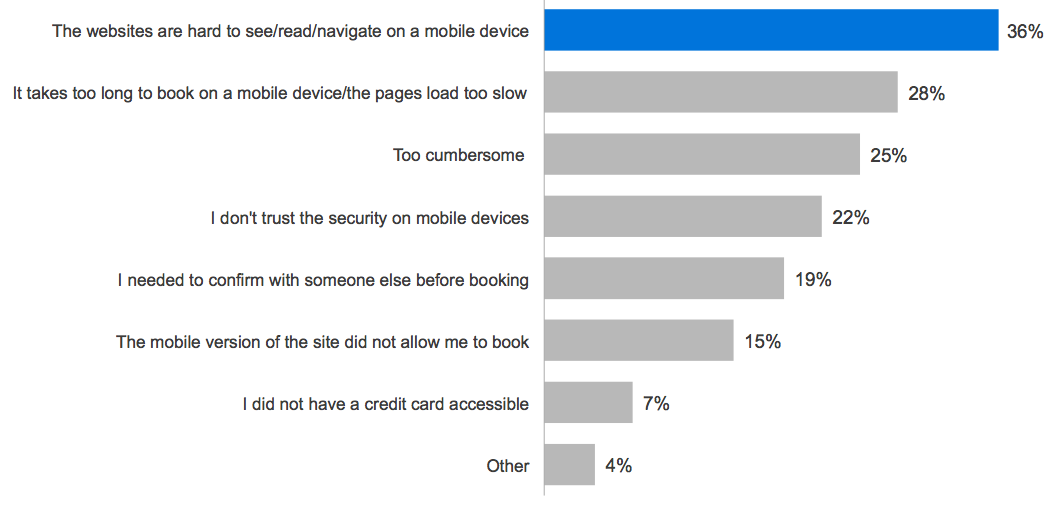

It’s also quite clear that when booking travel on a mobile device, travelers tend to book via mobile browser, rather than using apps. Not surprisingly, both on smartphones and tablets, a bad mobile website remains the number one deterrent to booking travel on a mobile device. (See graph below)

THE RISE OF ONLINE VIDEO

The use of online video for travel planning has always been popular, in particular in the aspirational phase of the decision-making, when travelers are still shopping around for a destination. It seems however that online video is gaining in both breadth and depth, making it an online source of information for 21% of leisure travelers and 26% of business travelers.

The report found that travelers watch a mix of user-generated content and professionally-made videos, confirming the importance of tapping into social platforms like Youtube or Vimeo. Here is the top 5 types of travel videos watched by all travelers:

- 62% Videos from hotels, airlines, cruises, tours, etc.

- 58% Trip reviews from experts

- 58% Videos from travel-related channels

- 56% Trip reviews from people like me

- 48% Videos made by people like me

Pretty fascinating to see how very little difference travelers seem to place on expert-generated content versus user-generated content. Yet, here is the kicker: Of travelers who watched online videos while planning travel, 45% of leisure travelers, 72% of business travelers and 74% of affluent travelers said they were prompted to book as result. Impressive stats from a travel marketing perspective !

CONCLUSION

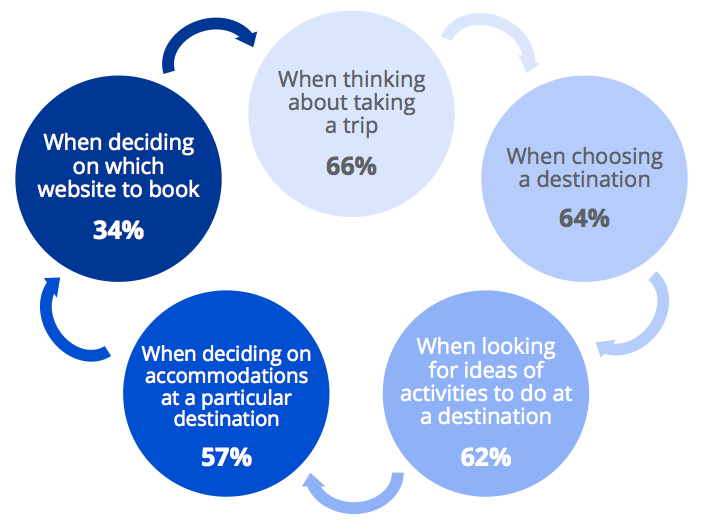

There is lots more in this report. It’s important to note, however, that generally speaking, travelers tend to be undecided when they begin their online process. More than 50% of them brainstormed or started thinking about a trip online. In fact, 65% of leisure and 70% of affluent travelers begin researching online before they have decided where or how to travel. Can you hear the bells of opportunity ringing here? For destinations, this is a clear signal that with a dynamic online strategy, reaching potential travelers in the early stage of the search process can create tangible results, in particular with leisure and affluent travelers.

With the Odyssey Travel App, you have at your fingertips a hotel platform, full of quality content from hotels, hotel chains, aggregators, Book Hotel & Travel and properties from around the world – all in one place.