It’s a fresh new year and we all look at 2021 with a glimmer of hope that things will improve in the travel industry. The Covid-19 virus is still very much active and impacting our universe, yet travel marketers must keep working with the future in sight. Status quo is not an option.

Read also: 5 Travel Marketing Trends For 2021

With this in mind, I thought I would share some interesting findings from a recent study published by Expedia Group Media Solutions. The extensive data comes from surveys conducted in Q4 2020 with over 11,000 travelers from 11 different countries. Here are some key highlights.

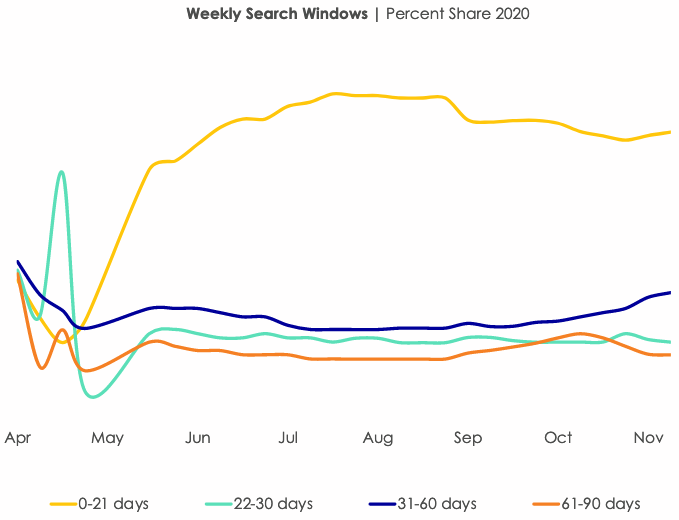

The Search Window Remains Narrow

The very first finding is undoubtedly the least surprising. Consumers now search mostly with travel intentions within the next 21 days or less. There is so much uncertainty with the evolution of this ongoing pandemic, going in and out of waves, that travelers have a hard time looking beyond that time span for travel intentions.

Takeaway: Travel marketers need to take this into consideration. It may be bold and original to have itineraries and promotions for 2022 and beyond. But that’s not necessarily the mindset consumers are in right now.

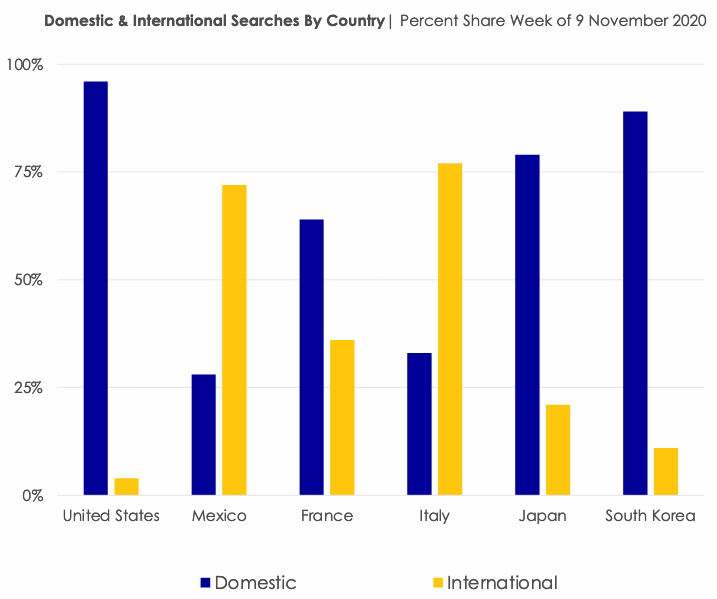

Domestic vs International

Where some travel marketers may go astray is in presuming that everybody is focusing on domestic travel only. Searches tend to confirm this trend in the United States, South Korea, Japan or France, for example. But in other countries such as Mexico or Italy, there remains a stronger volume for international travel search.

Takeaway: Not all countries behave the same way when it comes to searching online for travel. Domestic travel will remain a stronghold in 2021 with the virus still spreading, but some countries look outwards and may be interested in nearby, short-haul destinations.

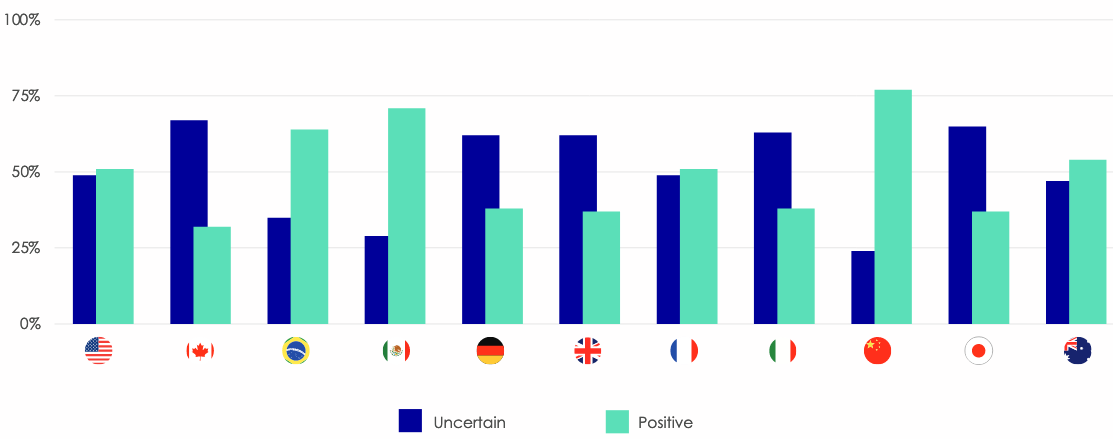

Canadians Uncertain About Traveling

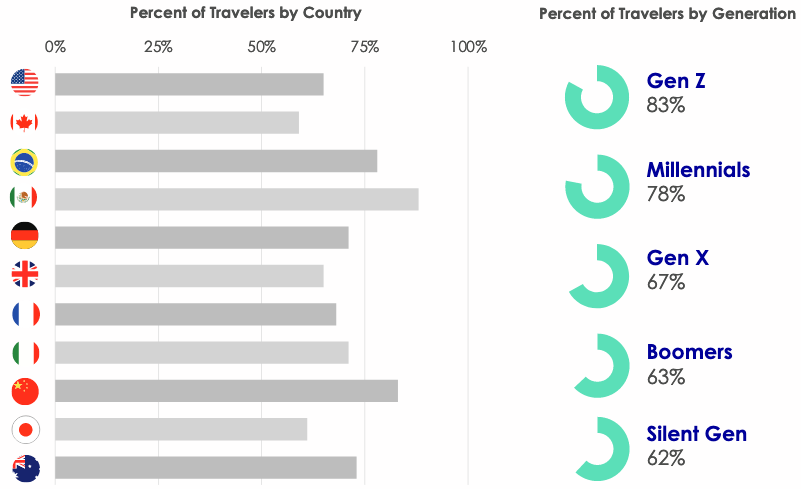

There is a section of the Expedia report dedicated to traveler sentiment and influences in the actual context. When asked “Thinking about traveling in the next 12 months, generally how do you feel?”, there was quite a difference in how various countries responded.

Chinese, Brazilian and Mexican travelers seem more confident about their travel intentions while uncertainty prevails with Japanese, British, Italian and German travelers. In fact, as a Canadian I was not at all surprised to see that our country is the least positive and most uncertain about travel in the upcoming 12 months!

Takeaway: Empathy and focus on sanitary measures will be important in upcoming communications for travel destinations and hospitality brands. This is particularly true with Canadians but also countries such as Germany, UK, France and Japan.

Read also: How Canadians Purchase Travel Post-Covid-19

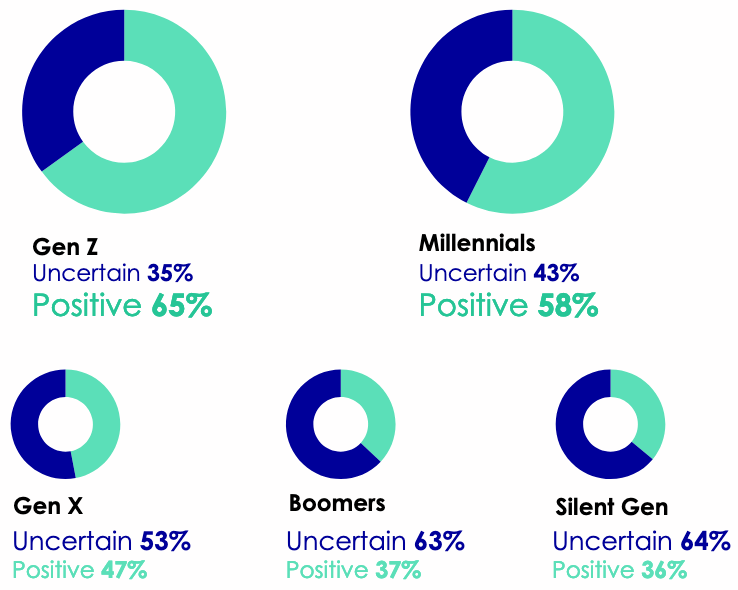

Younger Generations Are More Positive

How consumers feel about travel in the coming 12 months not only varies per country but also per age group. As could be expected, the younger folks tend to be more eager to travel despite of perceived risks and uncertainty in the immediate future.

As we can see from the Expedia study, the mindset is drastically different when comparing Gen Z or Millenials with Boomers and Silent Generation travelers.

In case you are wondering, and for clarity, here are the definitions for each age group:

- Gen Z: 1995-2001

- Millenials: 1980-1994

- Gen X: 1965-1979

- Boomers: 1946-1964

- Silent Gen: Born prior to 1946

Takeaway: How you post on social media and communications sent out by newsletters should be segmented. Messages must be adapted according to age groups as travel intent varies greatly between generations.

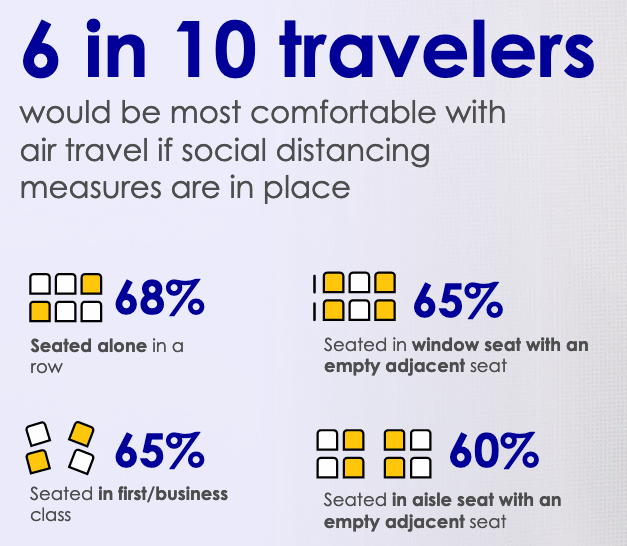

Flexibility and Health Are Key

According to the study, travelers are more comfortable traveling for leisure in the next 12 months with the following elements in place:

- Travel insurance or trip protection

- No concerns about health care expenses or coverage

- Access to full cancellation and refunds on transportation

- Access to full cancellation and refunds on accommodations

Thus, having booking policies that demonstrate flexibility is the biggest factor to instill confidence in booking travel. But again, this varies per country and per generations.

Having flexible conditions is a strong driver for bookings in particular with latin americans (Brazil, Mexico) and Chinese travelers. This is also true with younger generations, Gen Z and Millenials.

Sanitary measures important as well

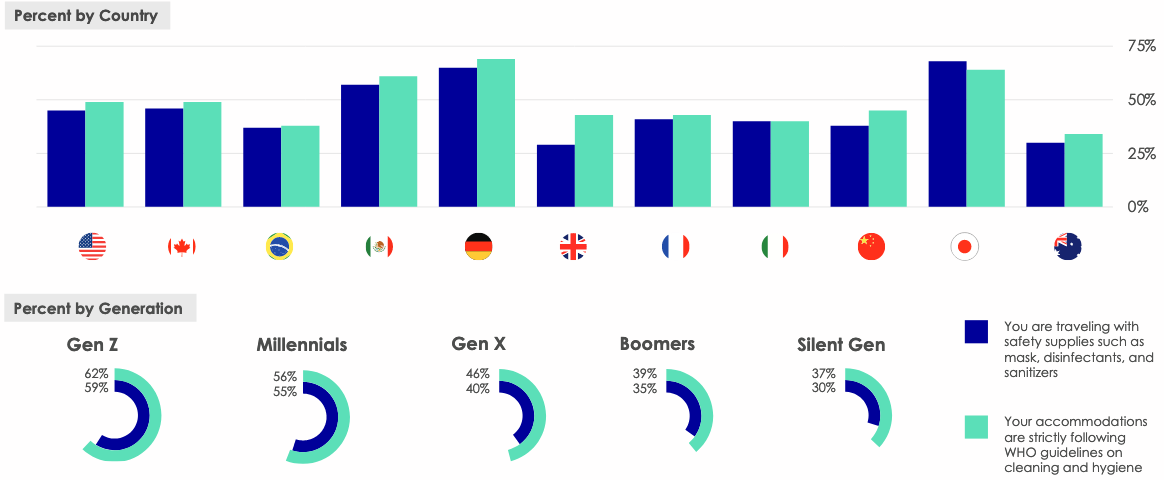

I was however a bit surprised by the data showing how travelers were concerned with health measures put in place by travel providers.

As we can see in the chart above, Japanese, German and Mexican travelers are those who show the greatest concern with safety measures put in place by accommodations and transportation providers. But what surprised me is the generation split, where I would have expected older travelers to show a greater interest in travel when health measures follow strict guidelines. Such does not seem to be the case.

Takeaway: Having flexible conditions in place will go a long way to help getting traveler confidence, specially with younger generations. Same goes with safety and hygiene measures, but don’t expect miracles with older generations, like Boomers and Silent Gen, in the upcoming 12 months.

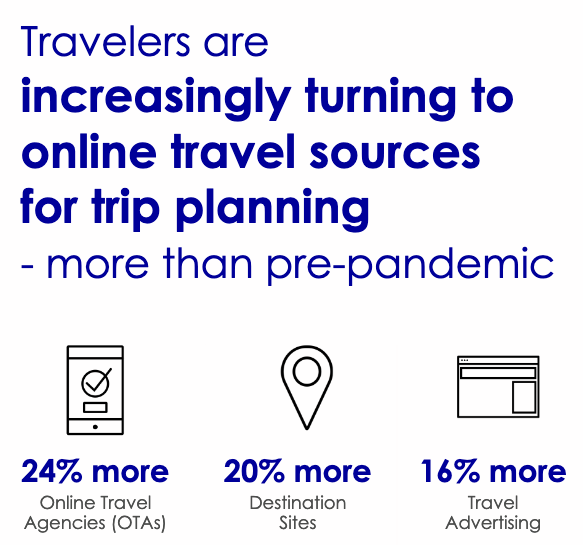

Online Sources Remain Important To Influence Booking Process

While there were many other components in the report I did not cover in this article, I did want to emphasize one last element. As can be expected, online sources remain key for travelers seeking information about their next trip.

When looking at various online sources, almost every indicator showed an increase in usage versus pre-pandemic. Sources include, in order of importance:

- Pictures and information on destination websites

- Pictures and information on hotel websites

- Expert reviews

- Reviews from friends and family

- Pictures from friends and family

- Pictures on social media

- Pictures on online travel agencies

- Travel agency

- Pictures and information travel advertising

- Pictures from influencers on social media

- Social media accounts travelers follow

Takeaway: Travelers want brands to be informative and professional in their online communications. As we can see above, destinations and hotel providers should work on their digital presence to ensure pictures, reviews and accurate information is conveyed in order to instill confidence.

Click here to download the complete (free) research from Expedia Group Media Solutions

Leave a Reply